Healthy thinking for better farming

Thanks to Farmstrong for this article. Written by Hugh Norriss

There is a lot going on in farming at this time of year with added stresses, physical demands and the cold, wet short days. As a result of all these added pressures it’s easy to fall into some bad thinking patterns. Hugh Norriss, Farmstrong’s wellbeing advisor, shares some tips on healthy thinking techniques and how you can catch the thought, check it and change it.

All of us can probably remember a time when we lost our temper and ended up breaking something or even hurting ourselves or someone else.

Recently I heard a story about a farmer who was under time pressure to load his cattle and lost his temper when the last one didn’t fit in. He was fired up and slammed the gate shut. The only problem was, he didn’t remove his hand and ended up breaking his arm. An extreme example, but it does show how strong emotions like anger and frustration can end badly.

It’s understandable that occasionally we have a short fuse or feel negative, but is it useful and productive? According to psychologists, angry and negative emotions make us less:

- effective at coming up with creative solutions to problems

- productive

- able to relate and get on with people.

Changing the way you think

Can we change the way we think and behave to be more positive, while also acknowledging our difficulties and challenges? This is all possible and a simple tool we can use to do this is called Catch it, Check it, Change it.

The negative thought cycle

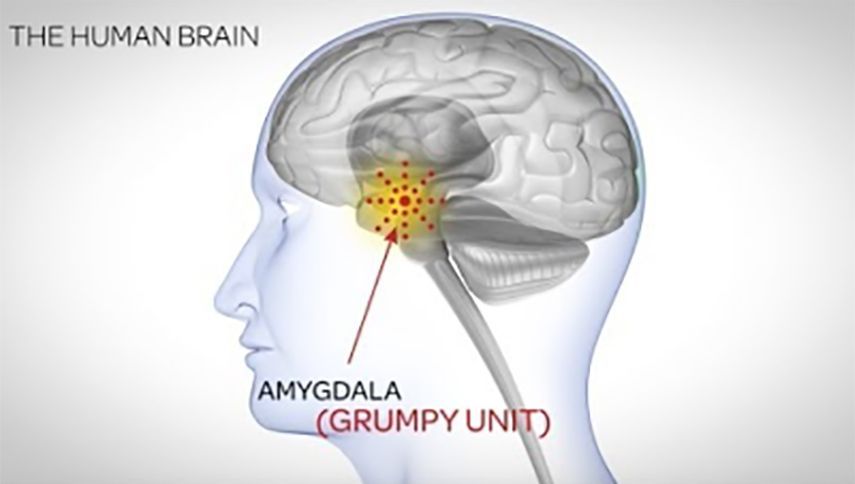

When we notice something negative happening, or even when we think about something going wrong, it triggers an emotion. The emotion might be frustration, anger or sadness and will lead to a behaviour. Depending on the emotion the behaviour might be lashing out, berating others, or withdrawal. These behaviours can be unhelpful and can drive our negative thinking further, creating a downward negative spiral where negative thoughts, emotions and behaviours reinforce each other.

Having a level of awareness of what’s going on with this cycle will mean that we can monitor our responses and break the downward spiral, benefiting ourselves and others.

Often, the easiest way to break the cycle is by noticing the negative thought and applying Catch it, Check it, Change it.

How does Catch it, Check it, Change it work?

Catch it

When you get upset about a situation imagine standing outside yourself and hitting the pause button. Take a deep breath then see if you can catch your thought, notice the emotion you are experiencing, and any impulse to behave in a certain way.

Check it

Then examine the thought and decide if there is a more positive interpretation without denying the reality of the situation. Try to be curious about what’s going on, rather than assuming you have all the facts. We often decide that the thought we’re having is the one and only reality, whereas almost always there are a number of interpretations about what’s happening, or what someone meant by what they said.

Change it

We can then change the thought to a more positive interpretation, or at least reserve judgement. More positive thoughts will lead to easier emotions and calmer behaviours, which will help you problem solve better. If you do discover that the situation is the worst possible scenario, at least you have given yourself breathing space.

Applying the above technique helps us get better at understanding how our thoughts affect our emotions in the long term and will ensure we are less prone to depression, anxiety and angry outbursts.

What else can you do to help when stressed?

A good coping mechanism for stressful situations is to take five or six deep breaths. This stops us acting and thinking impulsively and calms our nervous system leading to better choices about what to do and say next. Another positive behaviour is to take a short walk, which has a similar effect.

For longer-term benefits we can keep our emotions and thoughts more positive by being aware and putting into practice the five ways to wellbeing, which include:

- giving back

- keep learning

- connecting with others

- taking notice

- remaining active

Farmers are often pragmatic problem solvers. However, sometimes the problems become overwhelming. This is when we need to look carefully at our thoughts, emotions, behaviour cycle and talk with people we trust about what is going on.

Helpful advice

- Throughout the day notice the pleasant and unpleasant emotions you’re having and try to give them a name. A helpful list of emotions that might help you can be found here.

- Alternatively you can just label your emotional state as green, amber or red. Green is when you are calm, happy and relaxed. Amber is starting to get riled up and red is when you are heated and getting out of control. Sometimes this helps people share how they are feeling. Eg ‘I need to go for a walk I’m getting into the red zone.’

- Where possible, try to limit spending too much time with people who are negative about life, as this can infect you with negativity too.

For more information go to

- Dr Tom Mulholland and his approach to Healthy Thinking here.

- Sam Whitelock and the five ways to wellbeing

- BBC online health programme Headroom who first came up with Catch it, Check it, Change it.

For more great tips on wellbeing and how you can be looking after yourself, have a further look around Farmstrong. Make sure you take the Farmstrong wellbeing checklist too.